BILLED RECEIVABLE FINANCING

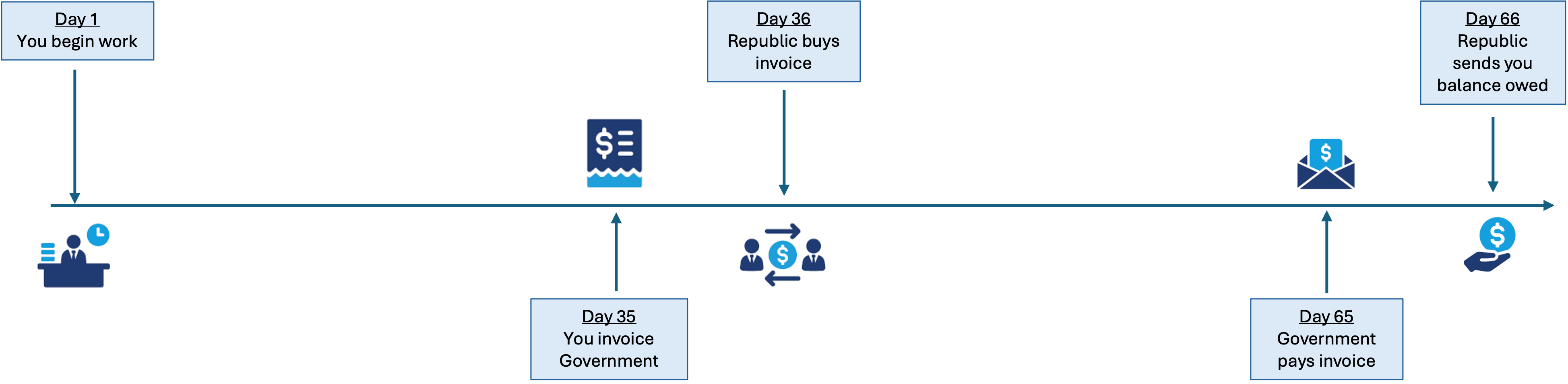

After much deliberation and research, Republic settled on a receivable financing program that utilizes a unique structure with significant benefits over a traditional Asset Based Loan (ABL) structure.

While the program has its roots in factoring, several refinements and enhancements have been added that lead to far lower cost, a reduction of debt, removal of restrictions on the use of funds, elimination of personal guarantees, improvement of balance sheets, and avoiding lien filings on company or personal assets.

The result is an affordable, frictionless, and reliable program to fuel growth.

Find out how we can help.